How to Report Income in Your Tax Return

Salaries tax is imposed on all income arising in or derived from Hong Kong from an office, employment or any pension. Here you can learn more about the territorial concept of taxation, how income earned outside Hong Kong is taxed, the exemptions or tax relief you could be eligible for and the types of documents you should keep to support your claim for exemption or tax relief.

Source of Employment

The Hong Kong tax system is based on the territorial concept. Salaries tax is imposed on all income arising in or derived from Hong Kong from an office or employment or any pension irrespective of whether tax on that income has been paid in other jurisdictions.

In determining the source of employment, the following three factors are relevant:

- the place where the contract of employment was negotiated and entered into, and is enforceable;

- the employer’s place of residence; and

- the place of payment of the employee’s remuneration.

In general, if all three factors take place outside Hong Kong, the employment is regarded as located outside Hong Kong. However, the Inland Revenue Department reserves the right to look beyond these factors in appropriate cases.

Further information can be obtained through the following link.

Departmental Interpretation & Practice Notes No. 10 (Revised) – The Charge to Salaries Tax (pdf file)Hong Kong Employment

If your source of employment is Hong Kong, e.g. you are employed by a Hong Kong company to work in Hong Kong, your full income is chargeable to salaries tax even if part of your duties are performed outside Hong Kong. However, you may claim exemption of income or relief from tax under certain circumstances on a year-by-year basis.

Non-Hong Kong Employment

If your source of employment is outside Hong Kong, e.g. you are assigned to work in Hong Kong for a few years by your non-Hong Kong employer and you have to perform part of your duties in other countries, you are only assessed on the income attributable to the services you rendered in Hong Kong, including leave pay attributable to such services, and generally according to the number of days you were in Hong Kong (day-in-day-out basis) in a year of assessment.

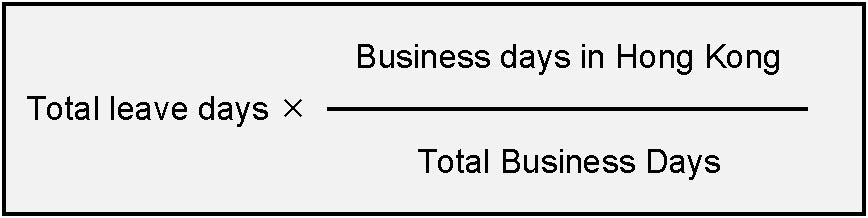

When calculating leave pay under these circumstances, leave days attributable to services rendered in Hong Kong are computed as follows:

Leave days attributable to services rendered in Hong Kong =

Business days in Hong Kong + Business days outside Hong Kong + leave days = 365 or 366

Full or Partial Exemption of Income or Tax Credit

You can apply for full or partial exemption of income or claim for tax credit when filing your Tax Return – Individuals (BIR60) and its Appendix if you satisfy one of the following conditions:

(A) Only Part of Your Employment Income Was Sourced in Hong Kong (i.e. under section 8(1A)(a) of the Inland Revenue Ordinance ("IRO))

This exemption only applies to employees whose source of employment is outside Hong Kong. As salaries tax in this case is only levied on income derived from services rendered in Hong Kong, income attributable to services rendered outside Hong Kong is exempt from tax. The amount of income exempted is generally computed by time-basis apportionment with reference to the number of days spent outside Hong Kong.

When counting the number of days in Hong Kong, the day of departure from Hong Kong and the day of arrival in Hong Kong are counted together as a single day.

Example

|

Arrival in Hong Kong |

Departure from Hong Kong |

Number of days in Hong Kong |

|---|---|---|

|

1 February at 23:30 |

4 February at 00:30 |

3 |

|

1 March at 11:30 |

1 March at 18:30 |

1/2 |

Thus, if your annual income for a year of assessment was $365,000 and you were in Hong Kong for 100 days of that year, your assessable income would be $365,000 x 100/365 = $100,000.

(B) All Services Were Rendered Outside Hong Kong During the Year (i.e. under section 8(1A)(b)(ii) of the IRO)

This exemption is generally available to employees irrespective of the locality of their employment. Attending trainings, meetings, or reporting in Hong Kong is regarded as services rendered in Hong Kong for the purpose of the exemption. You are exempt from salaries tax for a year of assessment only if you rendered all services outside Hong Kong in that year of assessment, unless you are a civil servant or a crew member of a ship or an aircraft. Income from services rendered in Hong Kong during visits not exceeding a total of 60 days in the year is also excluded from tax.

A visit means a short or temporary stay. Whether the nature of a trip to Hong Kong made by a Hong Kong resident is a visit or not depends on the circumstances of each case. In general, if a Hong Kong resident has a work base in a foreign country and is required to render services there as a permanent employee, the person’s occasional return to Hong Kong will be recognised as a visit.

In deciding whether visits to Hong Kong exceed a total of 60 days, the “days of presence” are counted. A day is counted even though you may be present in Hong Kong for only part of that day. Therefore, the day of departure from Hong Kong and the day of arrival in Hong Kong are counted as two days.

Example

| Arrival in Hong Kong | Departure from Hong Kong | Number of days in Hong Kong |

|---|---|---|

| 1 February at 23:30 | 4 February at 00:30 | 4 |

(C) Seafarers and Aircrews (income exemption under section 8(2)(j) of the IRO)

This exemption is only applicable to seafarers and aircrews (including masters and commanders). Income derived from services rendered by persons of this category is exempt from Salaries Tax for a year of assessment if they were present in Hong Kong on not more than 60 days in the basis period for that year of assessment and a total of 120 days falling partly within each of the basis periods for two consecutive years of assessment, one of which is the year of assessment being considered.

When counting the number of days present in Hong Kong, the “transit days” are counted as days present in Hong Kong. “Transit days” are days in which the crew member landed in Hong Kong but did not pass through the Hong Kong Border and Passport Control before departing for other places.

Example

|

Year of Assessment (Basis Period) |

Number of days present in Hong Kong |

Number of Transit Days |

Total number of days present in Hong Kong |

Exemption allowed under section 8(2)(j) of the IRO |

|

2022/23 |

59 |

16 |

75 |

No |

|

2023/24 |

40 |

10 |

50 |

Yes |

|

2024/25 |

46 |

13 |

59 |

Yes |

(D) Part of Your Income Has Already Been Charged to Tax in Any Other Territory Outside Hong Kong During the Year

(i) Income Exemption under Section 8(1A)(c) of the IRO

This exemption is generally only applicable to employees whose source of employment is in Hong Kong. If you have paid tax of substantially the same nature as Hong Kong salaries tax in a territory outside Hong Kong for income relating to services you rendered in that territory, that part of the income will be exempt from salaries tax under section 8(1A)(c). Evidence of foreign tax payment is required.

Example

Your total income for a year of assessment was $300,000 and two-thirds of the income ($200,000) was attributable to services you rendered in Country A. If you had paid tax similar to Hong Kong salaries tax in Country A on the income of $200,000, your assessable income in Hong Kong would only be $100,000.

(ii) Tax Credit under Section 50 of the IRO

This relief is applicable where a Hong Kong resident person (a person who is resident for tax purposes in Hong Kong) has paid tax in a territory outside Hong Kong which has made a comprehensive avoidance of double taxation agreement or arrangement ("CDTA") with Hong Kong ("DTA territory") in respect of your income derived from services rendered in that territory. With the support of evidence of foreign tax payment, the foreign tax paid will be allowed as a credit against Hong Kong tax payable in respect of the income concerned under section 50.

Example

You are a Hong Kong resident person. Your total income for a year of assessment was $3,000,000, out of which $1,000,000 was attributable to services you rendered in Country A ("relevant income"). You are chargeable to salaries tax of $450,000 (i.e. chargeable at standard rate) in respect of your total income in Hong Kong, and income tax of $100,000 in respect of the relevant income in Country A. If Country A is a DTA territory and you claim for tax credit in respect of the income tax paid in Country A, your salaries tax payable in Hong Kong will be reduced from $450,000 to $350,000.

(iii) Changes in Tax Treatments

For a year of assessment up to 2017/18

If you are a Hong Kong resident person and have paid tax similar to Hong Kong salaries tax in a DTA territory in respect of your income derived from services rendered in that territory, you may either apply for income exemption under section 8(1A)(c) or claim for tax credit under section 50.

From the year of assessment 2018/19 onwards

- Section 8(1A)(c) is not applicable to income derived by a person from services rendered in a DTA territory. Relief from double taxation in respect of such income can only be provided by way of tax credit under section 50.

- A claim for tax credit in respect of Hong Kong tax payable for the year of assessment 2018/19 or any subsequent year of assessment may be made before

(a) the end of 6 years after the end of the year of assessment; or

(b) the end of 6 months after imposing liability or additional liability to Hong Kong tax in respect of the income on which foreign tax has been assessed,

whichever is the later. - If a person makes a claim for tax credit and an assessor refuses to allow the claim, the assessor must give the person a written notice of refusal and the person has the same rights of objection and appeal as if such notice were a notice of assessment.

- The amount of any relief from double taxation granted (whether by way of income exemption under section 8(1A)(c) or tax credit under section 50) must not exceed the amount of the relief that would be granted had all foreign tax minimization steps been taken. A person must take all reasonable steps (such as claiming or securing the benefit of, relief, deductions, reductions or allowances and making elections for tax purpose) to minimize the amount of his or her foreign tax payable.

- If the amount of the relief from double taxation previously granted (whether by way of income exemption under section 8(1A)(c) or tax credit under section 50) to a person becomes excessive as a result of an adjustment to the amount of the foreign tax under the laws of the foreign territory, the person must give the Commissioner written notice of the adjustment within 3 months after the adjustment is made.

(E) Salaries Tax Concessions for Eligible Carried Interest under Schedule 16D of the IRO

From the year of assessment 2020/21 and onwards, salaries tax concessions were provided to qualifying employees for eligible carried interests received by, or accrued to, them by way of profit-related return from their provision of investment management services for a certified investment fund or specified entity.

Frequently asked questions about Eligible Carried InterestApplication for Exemption of Income or Relief from Tax

Exemption or relief is only granted upon application with supporting documents. If you are seeking tax exemption or relief you must complete, as appropriate, Section 3 (Relief Claimed under Double Taxation Arrangement(s)) or Section 4 (Application for Full/Partial Exemption of Income included under Part 4.1 of BIR60) of the Appendix to Tax Return – Individuals (BIR60).

If salaries tax concessions for eligible carried interest are claimed, you must complete the relevant part in Section 4 of the Appendix to BIR60 and submit supplementary form SP4 which can be downloaded from the Department's web site (www.ird.gov.hk/soleprop_e). After completion, the supplementary form SP4 must be printed out for signing and submitted together with the tax return.

Supporting Documents

If you are claiming exemption or relief under section 8(1A)(c) of the IRO or a tax credit under Double Taxation Arrangement(s), you must submit evidence of tax payment such as your Individual Income Tax Return in the relevant country/territory and tax receipts, detailed computation of amounts for which relief sought and a schedule of your itinerary.

In processing the claim for either exemption or relief, you may be required to provide copies of the following documents:

- employment contract

- letter of assignment to Hong Kong (for expatriates coming to work in Hong Kong)

- tax payment notices or receipts issued by tax authorities outside Hong Kong

- passport or another travel document showing your movements into and outside Hong Kong in the relevant year of assessment

- schedule of your movements into and outside Hong Kong in the relevant year of assessment (1/4/yyyy – 31/3/yyyy) in the following format: