How the Provision of a Place of Residence to an Employee is Taxed

If your employer provides you with a place of residence, rental value (RV) of it should be computed and assessed to salaries tax. This article will tell you more about how the rental value should be computed, what happens in special cases that might apply to you, the documents you should retain and what to do if you have any further questions.

A Place of Residence or Housing Benefits

If the Assessor of the Inland Revenue Department accepts that your employer has provided you with a place of residence, only the RV will be computed and charged to tax. If not so accepted, the benefit provided by your employer must be assessed as a perquisite at its cash value.

Examples of perquisites are:

- rental allowance;

- refunds of mortgage payments; and

- subsidies on mortgage interest payments.

When an Employee is Provided with a Place of Residence

Housing benefits derived from your employment are part of your income. If you are provided with a place of residence by your employer or its associated corporation, the RV of that place of residence should be included in your assessable income. The RV is calculated at 4%, 8% or 10% of your total net income after deducting outgoings and expenses (excluding expenses of self-education), depending on the type of accommodation provided.

|

Type of Accommodation |

Percentage |

|---|---|

|

Residential unit/serviced apartment |

10% |

|

2 rooms in a hotel, hostel or boarding house |

8% |

|

1 room in a hotel, hostel or boarding house |

4% |

Serviced apartments are popular nowadays. Typically, they are fully furnished units or apartments with domestic facilities such as cooking and laundry facilities available, and a minimum period of stay is usually required. The Inland Revenue Department does not generally regard serviced apartments as rooms in hotels, hostels or boarding houses, although individual cases may be examined in detail to determine the nature of the accommodation. Thus, if your place of residence is a serviced apartment, the rate of 10% will generally be applied in computing the RV.

The rent that you pay to your employer or landlord can be deducted to arrive at the RV. If the place of residence is a residential property, you can elect to include the “rateable value” of the property instead of the RV, if that will reduce the amount of tax to be paid. The following table provides more information.

|

Scenario |

Adjustment to the RV |

|---|---|

|

No rent paid |

No adjustment |

|

Rent paid |

Deduct net rent paid from the RV |

|

If the employee’s tax liability can be reduced |

The employee may elect to include the rateable value of the residential unit instead of the RV |

The following examples show how rental value is computed.

Example 1

Mr C earned $600,000 in a year. His employer, S Ltd, provided him with a flat as his place of residence. He claimed deductions for his annual membership fee to the Hong Kong Institution of Engineers of $2,000, contributions to a Mandatory Provident Fund (MPF) scheme of $18,000 and expenses of self-education of $27,500 in that year.

Mr C’s assessable income would be computed as follows.

|

$ |

|||

|---|---|---|---|

| Income |

600,000 |

||

| RV | $(600,000 – 2,000)x 10% |

59,800 |

|

|

659,800 |

|||

|

Less: |

Outgoings and expenses |

(2,000) |

|

|

|

MPF contributions |

(18,000) |

|

|

|

Expenses of self-education |

(27,500) |

|

| Assessable Income |

612,300 |

||

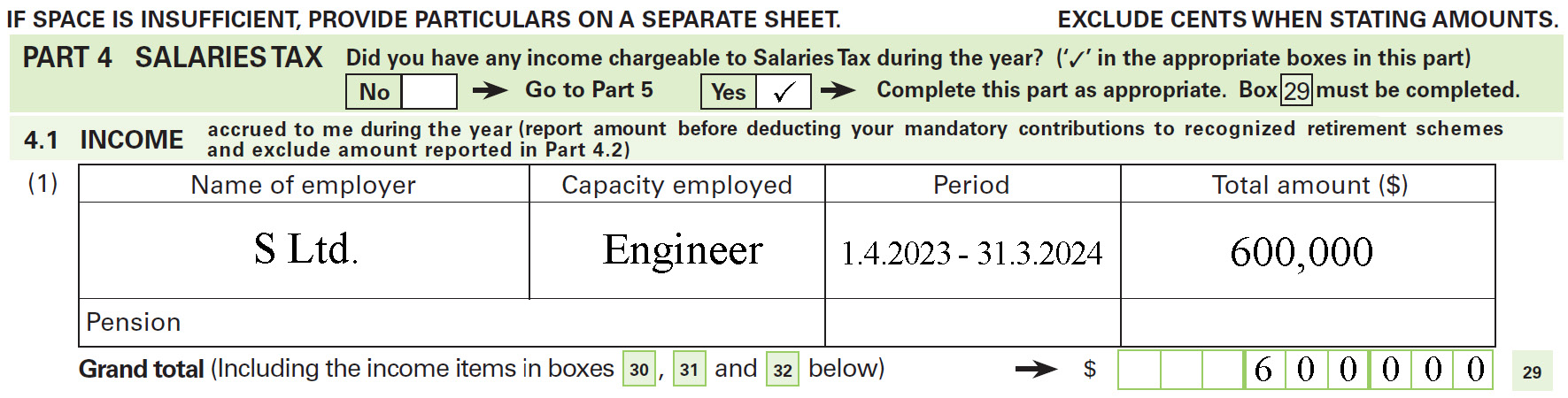

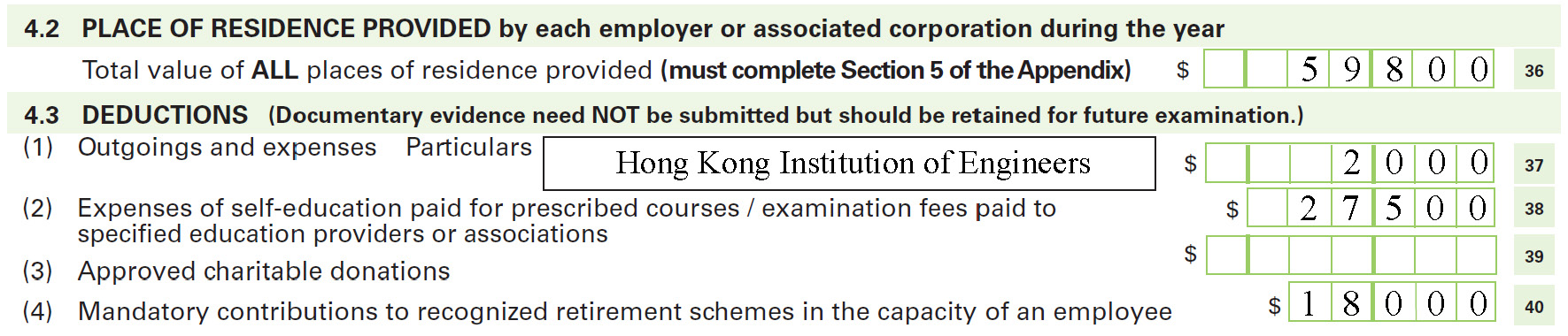

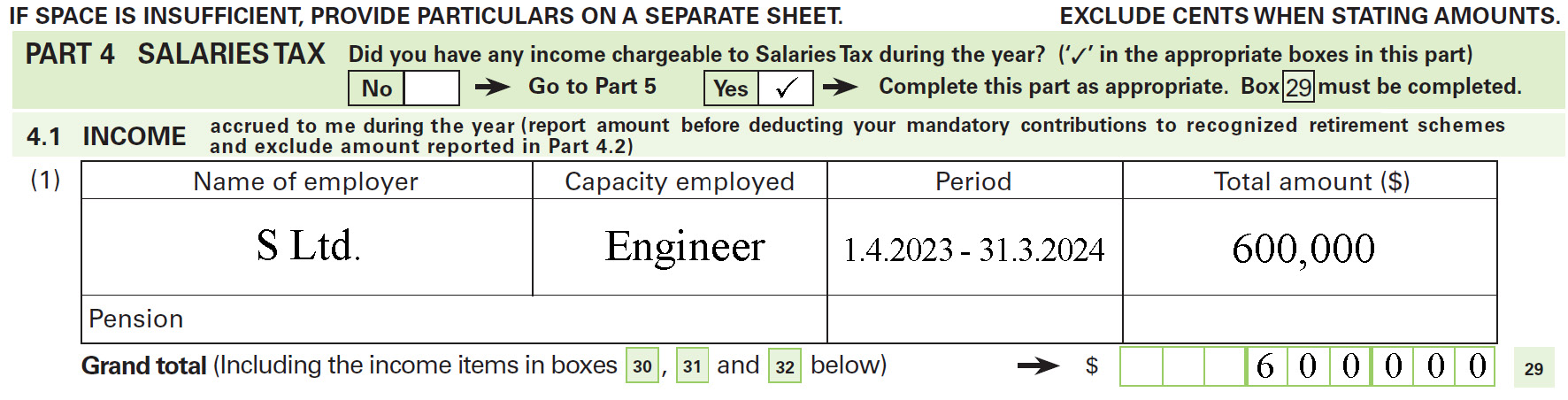

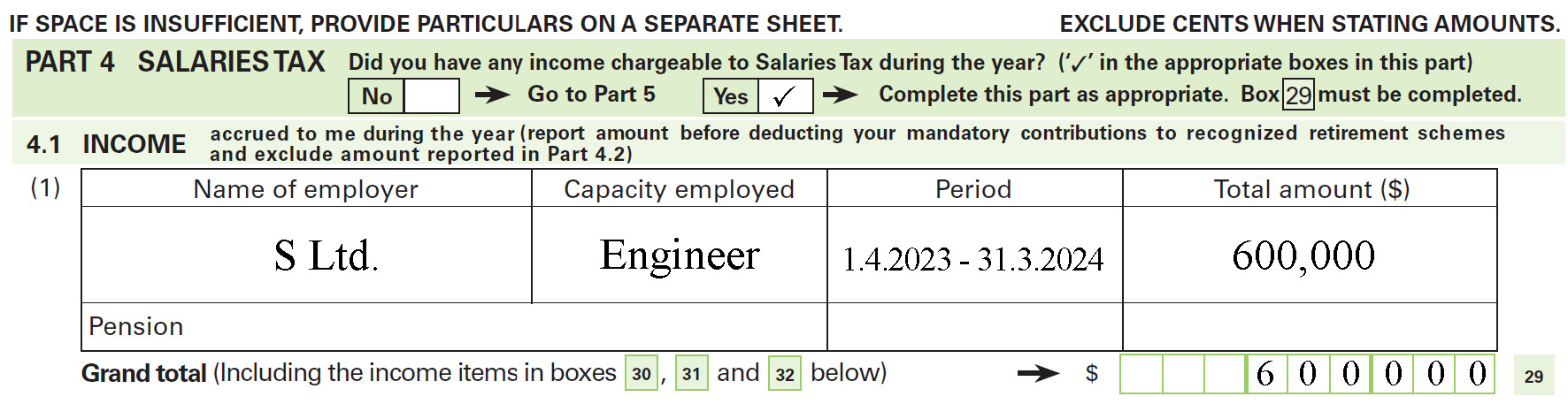

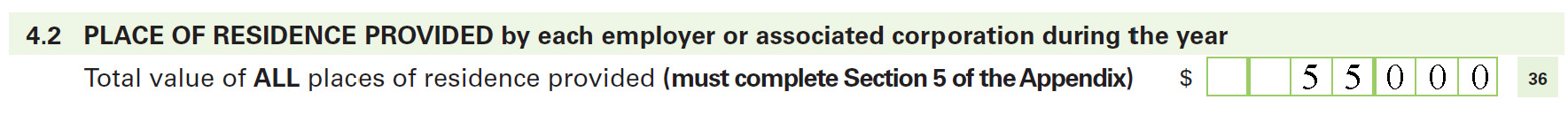

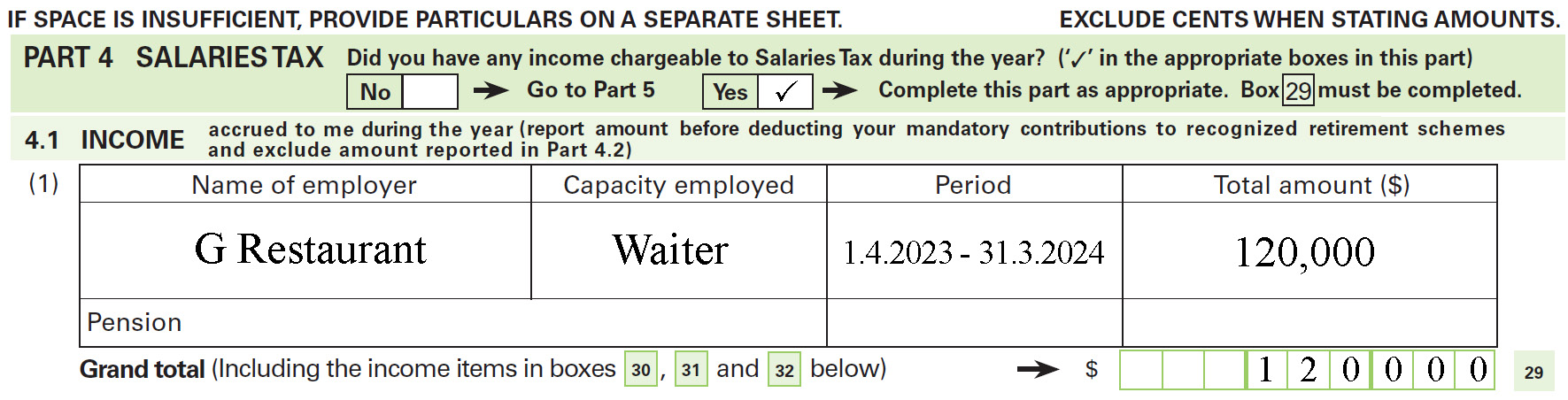

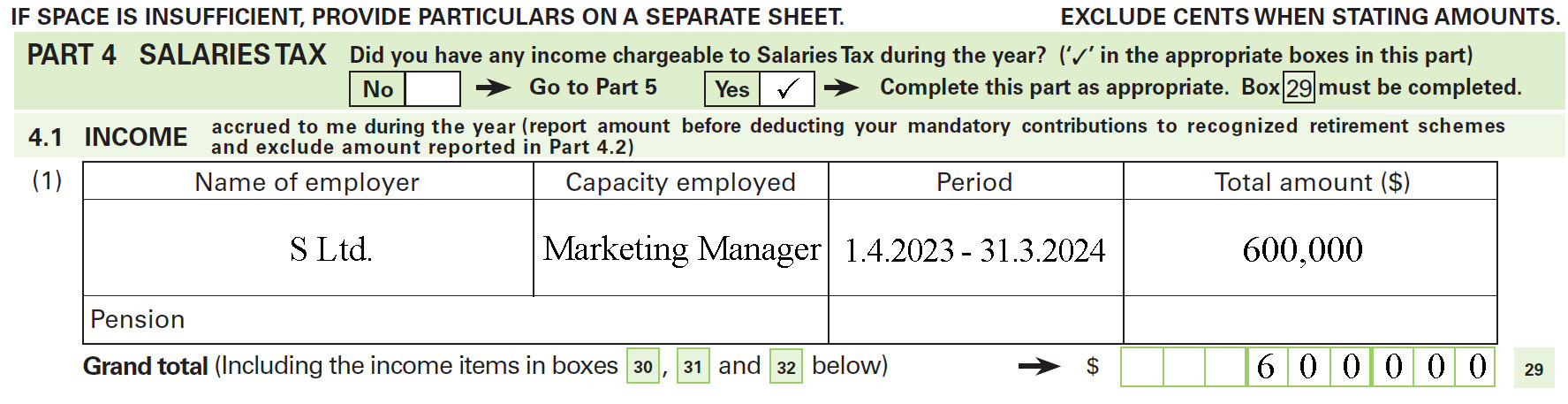

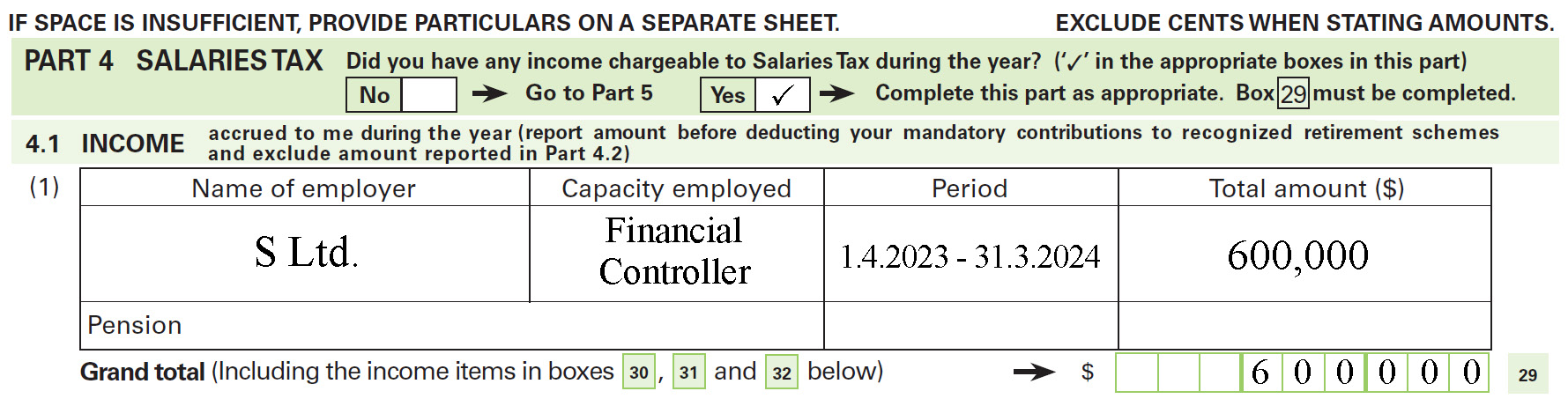

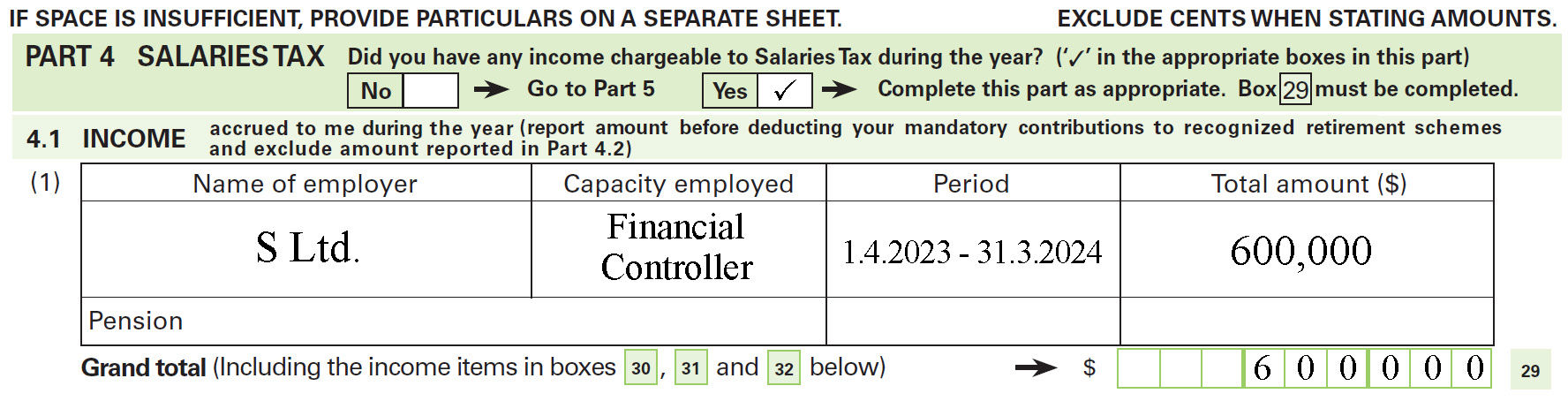

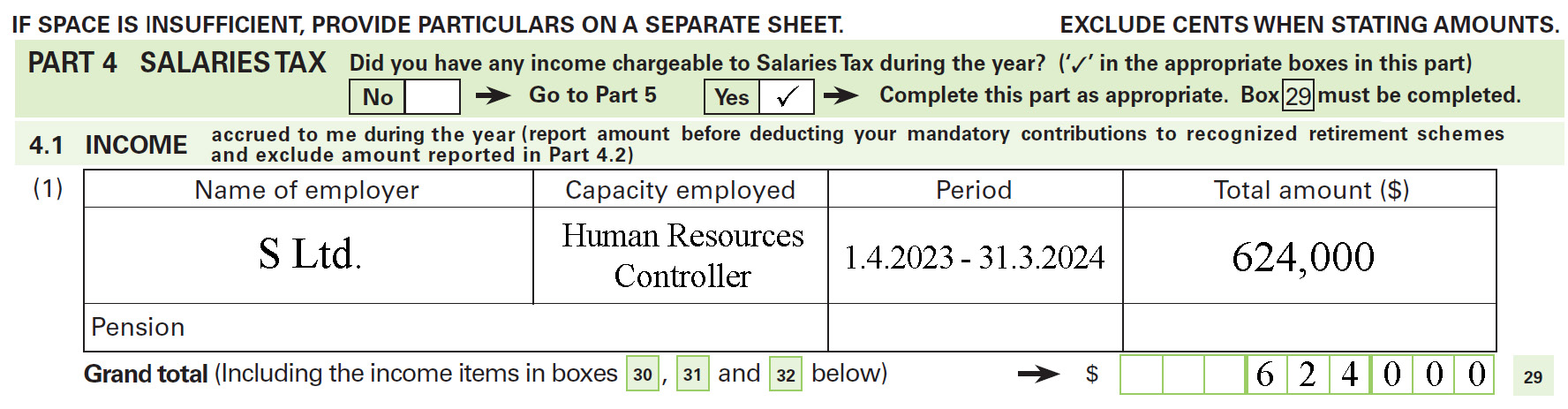

Mr C's Tax Return − Individuals (BIR60)

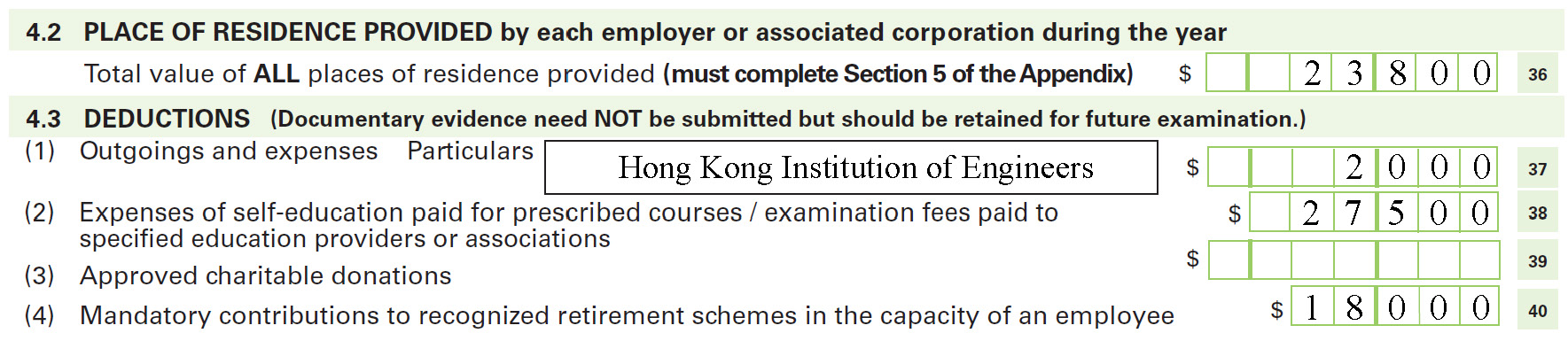

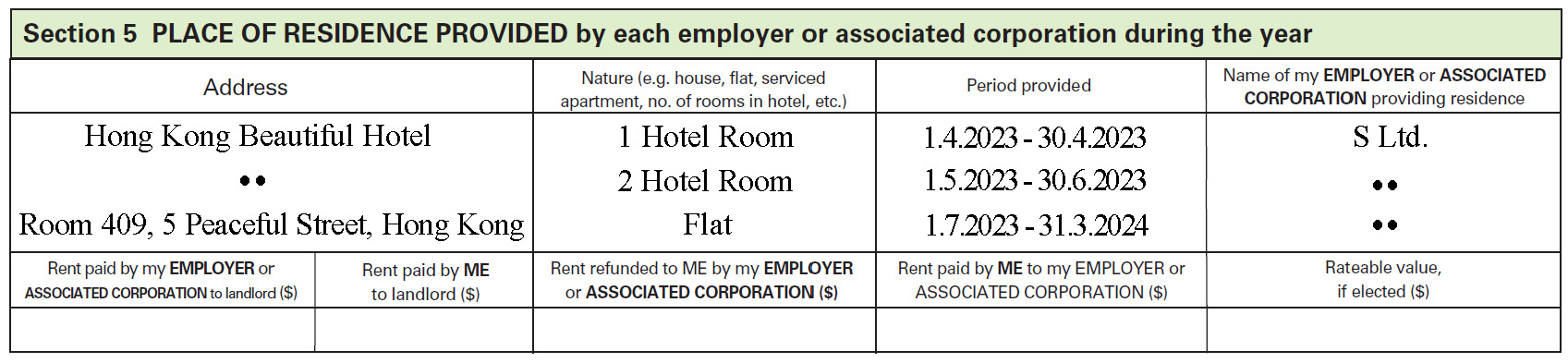

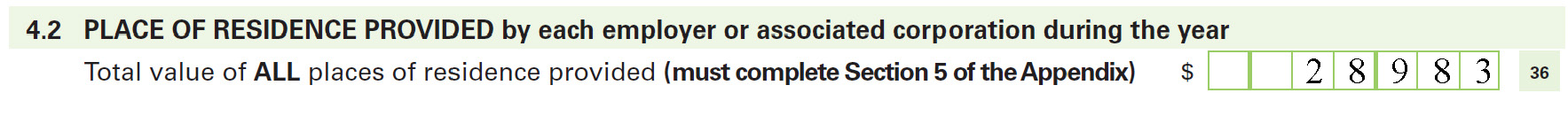

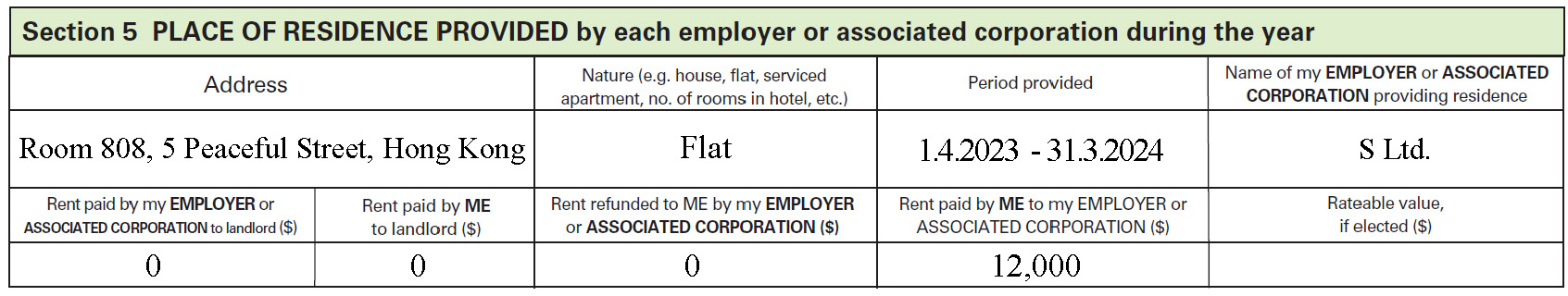

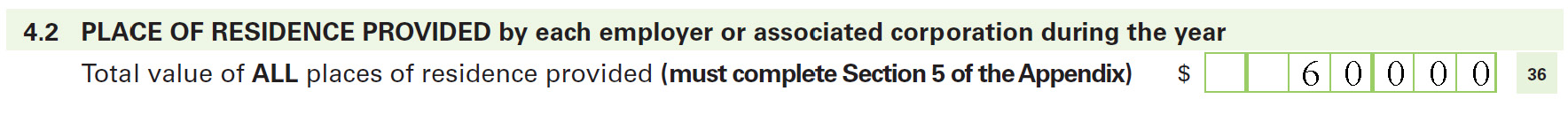

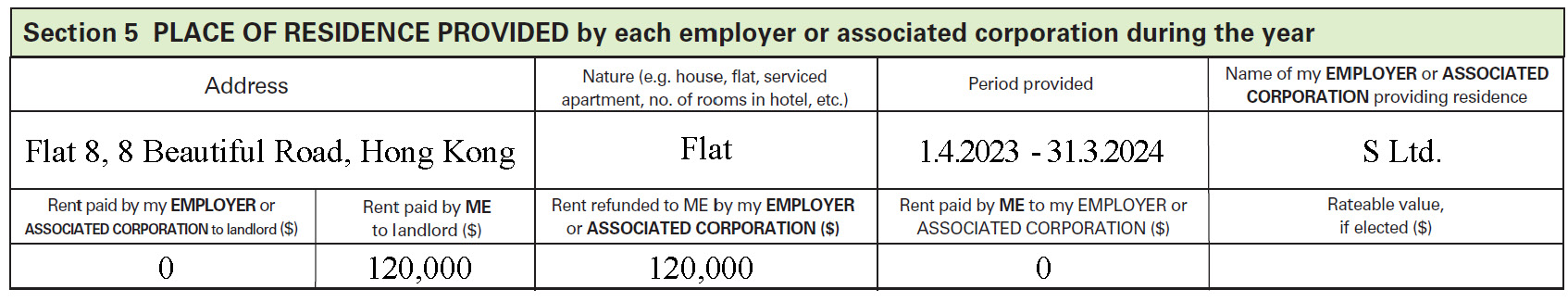

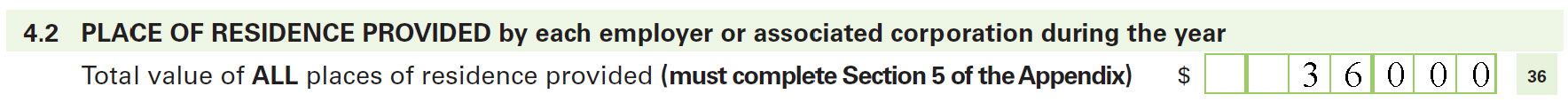

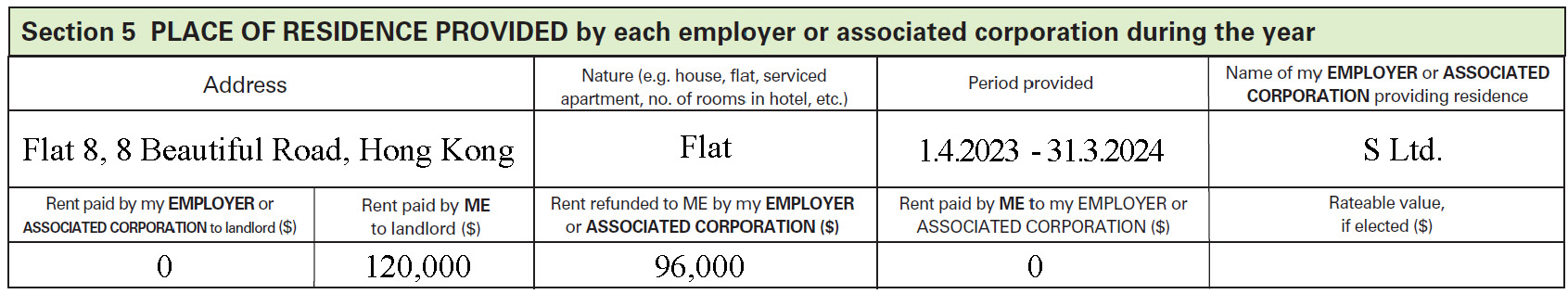

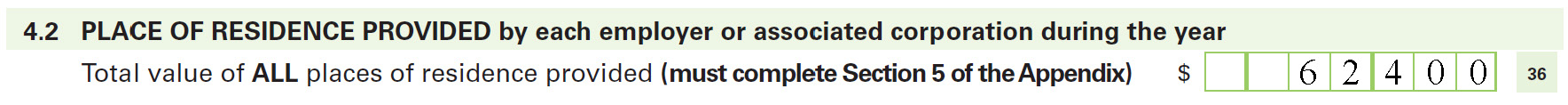

Appendix to BIR60

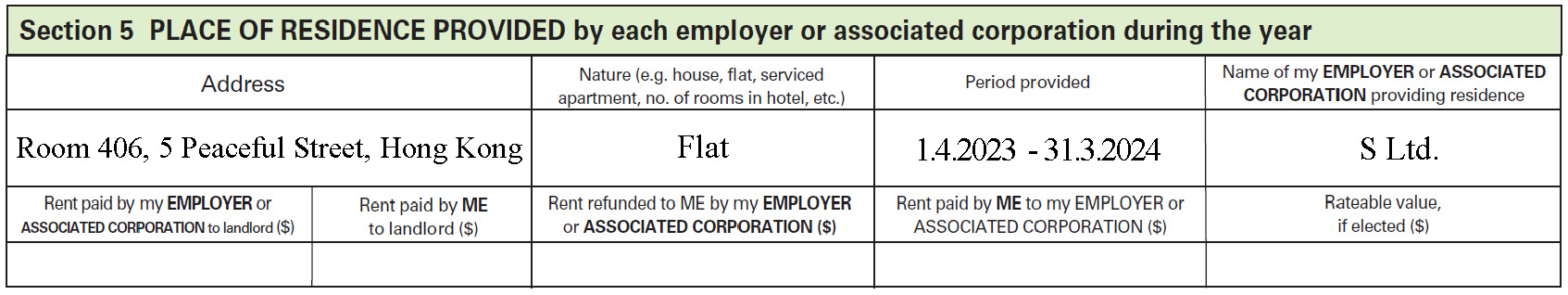

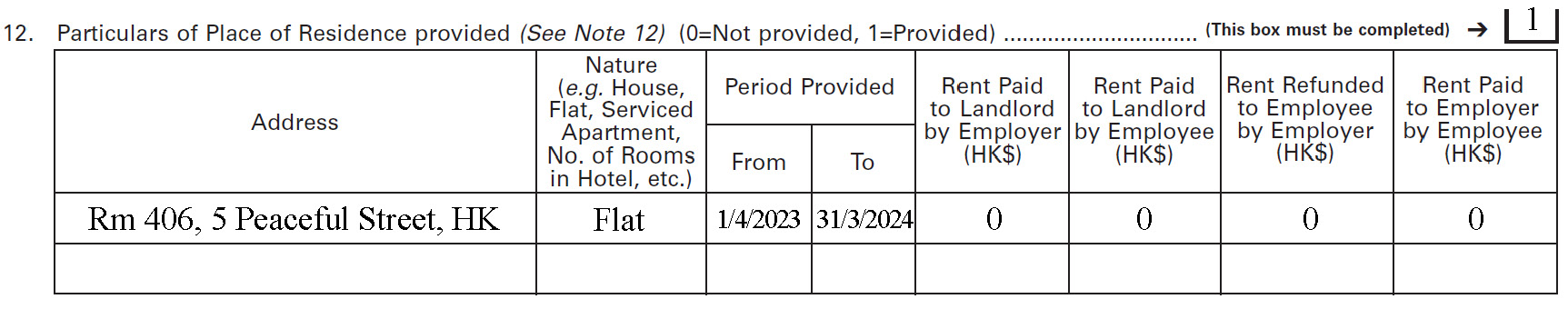

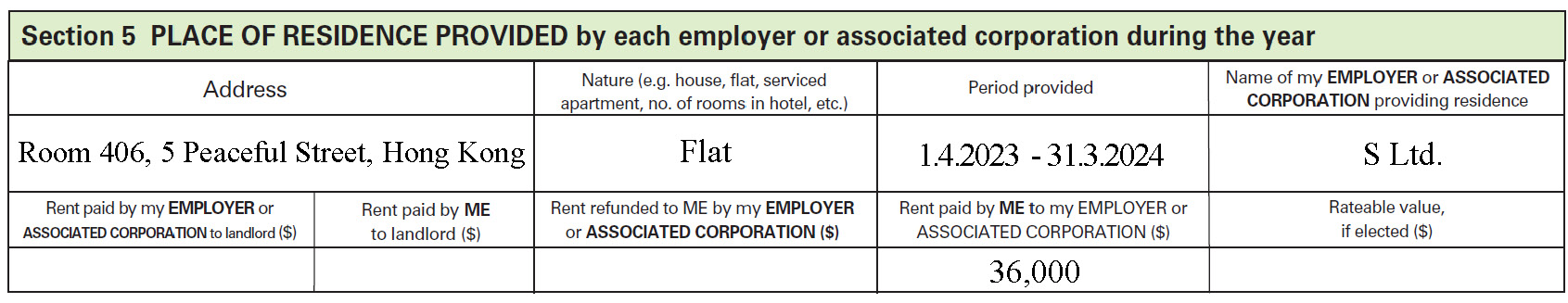

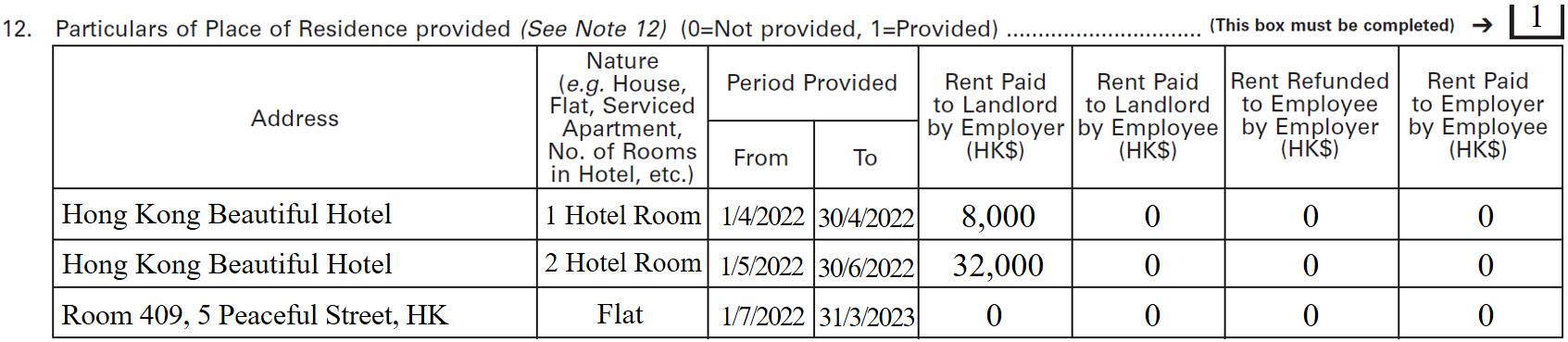

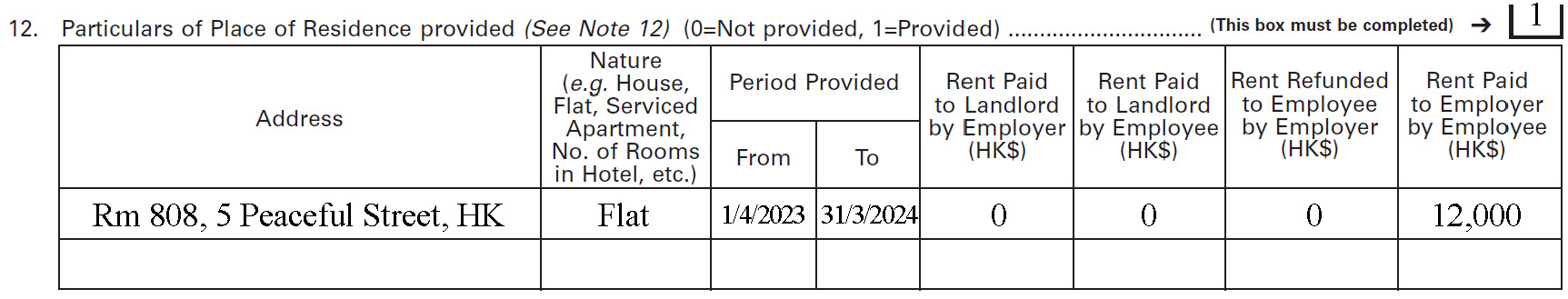

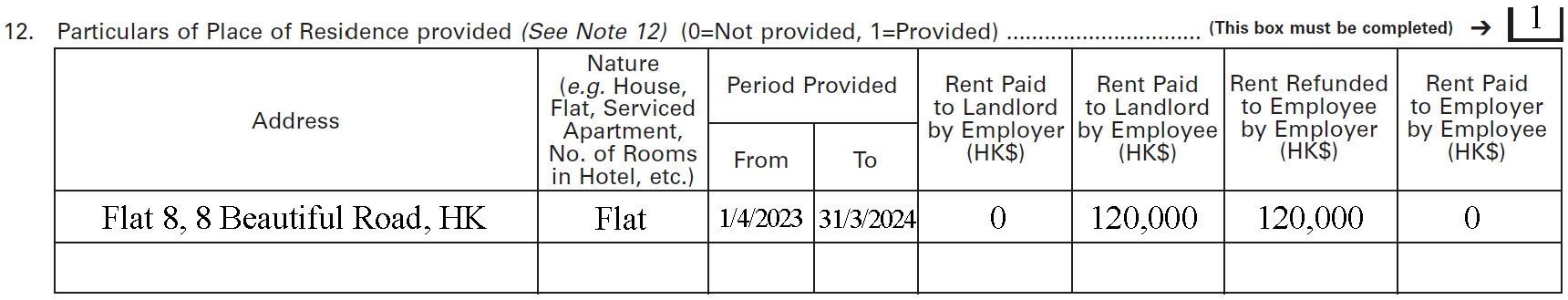

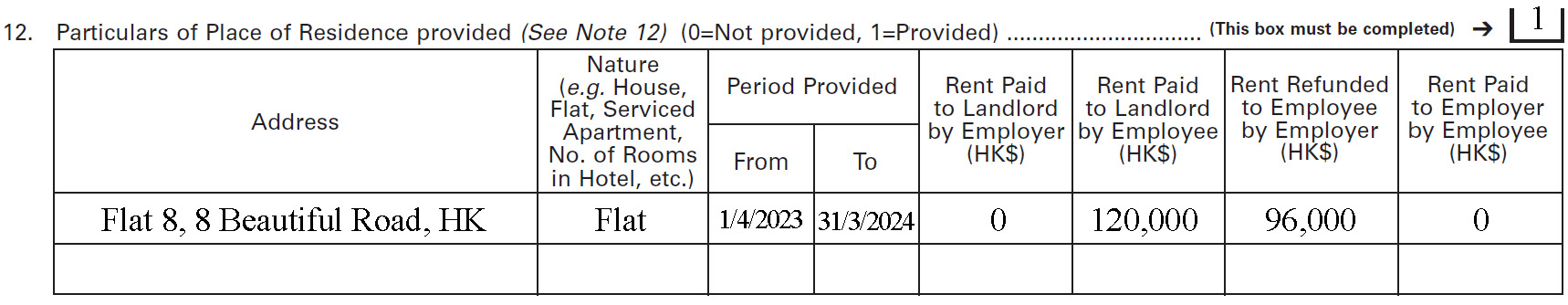

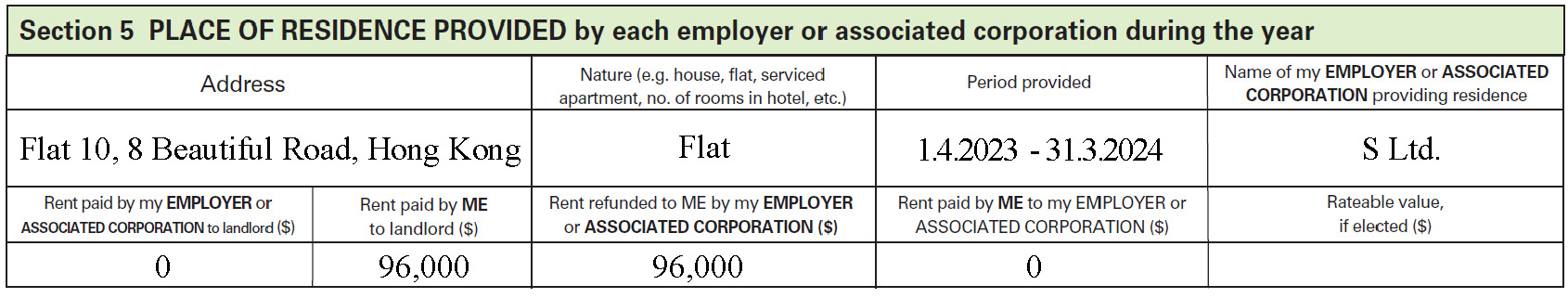

Mr C's Employer's Return of Remuneration and Pensions (IR56B)

Example 2

What would be the case if Mr C from Example 1 was required to pay monthly rent of $3,000 to his employer?

Mr C’s assessable income would be computed as follows.

|

$ |

|||

|---|---|---|---|

| Income |

600,000 |

||

| RV | $(600,000 – 2,000) x 10% - $36,000 |

23,800 |

|

|

623,800 |

|||

| Less: | Sum of deductions in Example 1 |

(47,500) |

|

| Assessable Income |

576,300 |

||

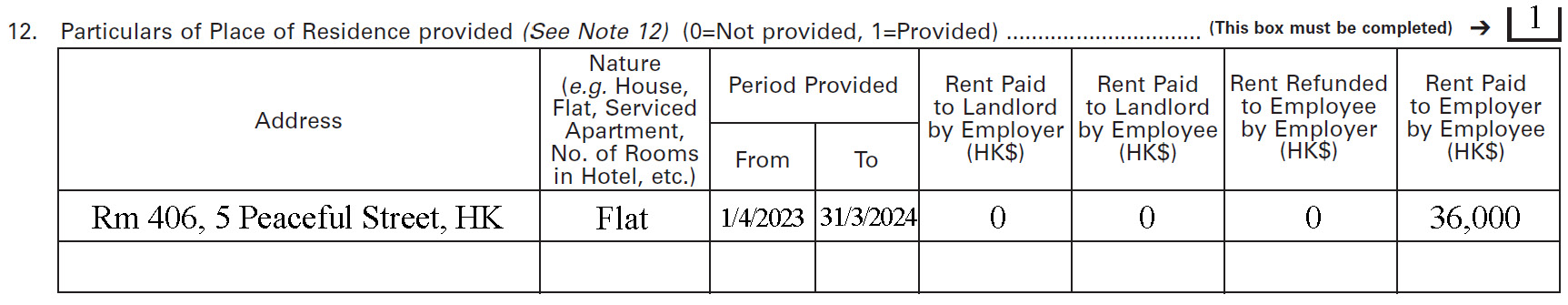

Mr C's Tax Return − Individuals (BIR60)

Appendix to BIR60

Mr C's Employer's Return of Remuneration and Pensions (IR56B)

Example 3

Mr L came to work in Hong Kong on 1 April 2024. He was remunerated at a salary of $50,000 per month with a place of residence. During his first month in Hong Kong he occupied one room in a hotel for a monthly rent of $8,000. On 1 May 2024, his wife and children arrived and the family moved into a 2-bedroom suite in the hotel for a monthly rent of $16,000. On 1 July 2024, Mr L and his family moved into a flat owned by his employer.

The RV should be computed as follows.

|

|

|

$ |

|---|---|---|

|

1 April 2024 – 30 April 2024 |

($50,000 x 1 x 4%) |

2,000 |

|

1 May 2024 – 30 June 2024 |

($50,000 x 2 x 8%) |

8,000 |

|

1 July 2024 – 31 March 2025 |

($50,000 x 9 x 10%) |

45,000 |

|

RV |

|

55,000 |

Mr L's Tax Return − Individuals (BIR60)

Appendix to BIR60

Mr L's Employer's Return of Remuneration and Pensions (IR56B)

Example 4

Mr C was a waiter at a restaurant with an annual income of $120,000. He and 5 other colleagues lived in a 3-bedroom flat provided by their employer, G Restaurant. He and his colleague, Mr N, occupied one of the bedrooms. How should his RV be computed?

This form of housing benefit is rather common in Hong Kong. It would be regarded as similar to occupying a room in a boarding house, and Mr C’s RV would be computed at 4% of his income, that is, $120,000 x 4% or $4,800.

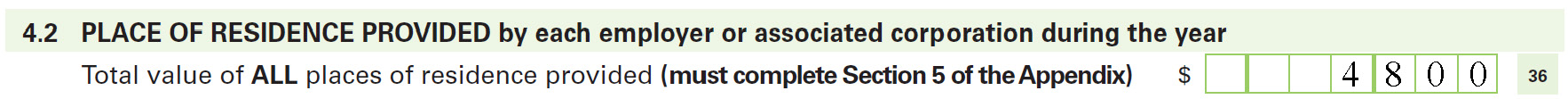

Mr C's Tax Return − Individuals (BIR60)

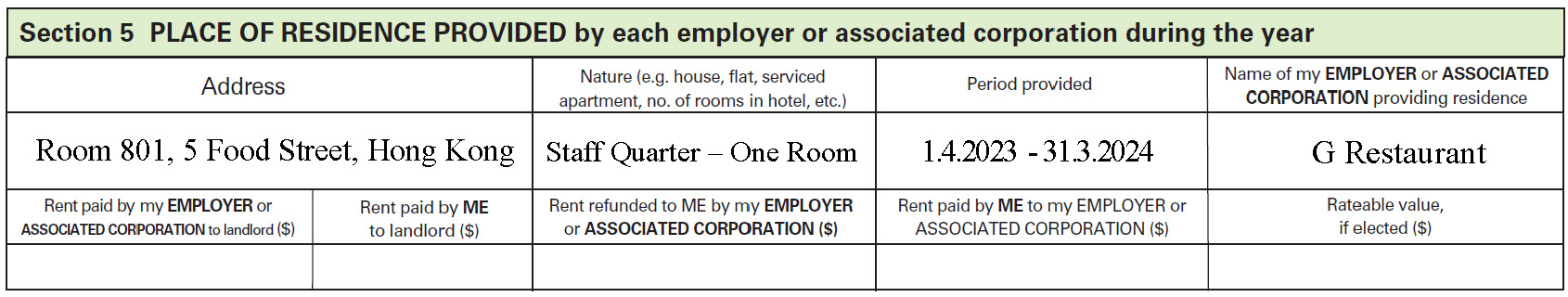

Appendix to BIR60

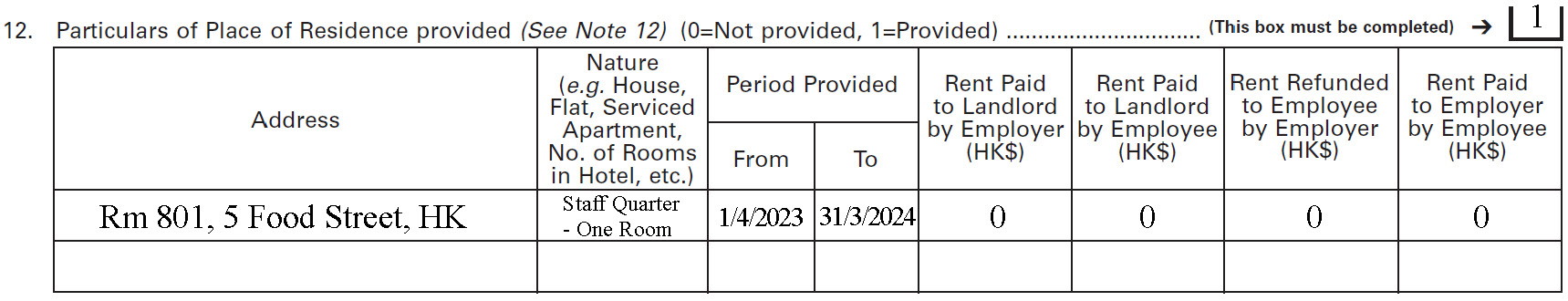

Mr C's Employer's Return of Remuneration and Pensions (IR56B)

Example 5

Ms L was employed by a foreign company, S Ltd. During the year of assessment 2024/25, her annual income was $600,000 and she stayed in Hong Kong for 250 days. While in Hong Kong she lived in a flat provided by her employer and a rent of $1,000 per month was deducted from her salary.

If the Assessor accepted Ms L’s claim and assessed her income on a day-in-day-out basis, Ms L’s assessable income would be computed as follows.

|

|

|

$ |

|---|---|---|

|

Income computed for the 250 days |

$(600,000 x 250/365) |

410,958 |

|

RV |

$(410,958 x 10% - 1,000 x 12) |

29,095 |

|

Assessable Income |

|

440,053 |

Ms L's Tax Return − Individuals (BIR60)

Appendix to BIR60

Ms L's Employer's Return of Remuneration and Pensions (IR56B)

Employer Refunds All or Part of the Rent Paid by Employee

When your employer has established clear guidelines for control and has exercised proper supervision over the reimbursement of either all or part of the rent that you pay as tenant to the landlord, the Assessor will accept the arrangement as if the employer directly provides a place of residence to the employee. The RV will be calculated and included in your assessable income and the rental reimbursements will not be treated as income.

However, if your employer does not control how you spend the money or does not exercise proper control over the expenditure, the Assessor will regard the reimbursements as a cash allowance and include the full amount in your assessable income.

Proper control means:

- a clearly defined system is in place, under which the ranks of those employees who are entitled to rental reimbursements and the limits of their entitlements are clearly laid down;

- the mode of housing benefit that you as an employee are entitled to and the limit of rental reimbursement are clearly specified in your contract of employment; and

- your employer examines the tenancy agreement and rental receipts and verifies the actual payment of rent against the tenancy agreement at regular intervals, and retains the relevant documents as records.

The following examples show how an employee’s assessable income will be computed when his employer refunds all or part of the rent to him.

Example 6

Apart from paying salary of $50,000 every month, Ms W’s employer also granted her a full refund of the rent of $10,000 she paid for her flat upon inspection of the rental receipts. Ms W’s assessable income would be computed as follows.

|

|

|

$ |

|---|---|---|

|

Income |

$(50,000 x 12) |

600,000 |

|

RV |

$(600,000 x 10%) |

60,000 |

| Assessable Income |

660,000 |

|

Ms W's Tax Return − Individuals (BIR60)

Appendix to BIR60

Ms W's Employer's Return of Remuneration and Pensions (IR56B)

Example 7

If Ms W in Example 6 was granted a partial refund of rent of $8,000 per month, how should her assessable income be computed? The rent ‘suffered’ by Ms W would be deducted from the RV computation as follows.

|

|

|

$ |

|---|---|---|

|

Income |

|

600,000 |

|

RV |

$600,000 x 10% - $(2,000 x 12) |

36,000 |

|

Assessable Income |

|

636,000 |

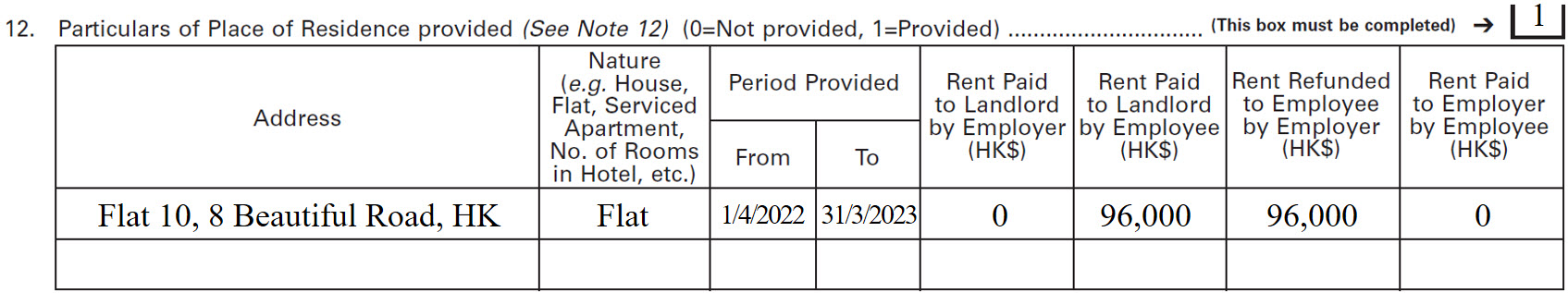

Ms W's Tax Return − Individuals (BIR60)

Appendix to BIR60

Ms W's Employer's Return of Remuneration and Pensions (IR56B)

Example 8

Ms H was remunerated at a salary of $50,000 and accommodation benefit of $10,000 per month. She occupied a flat for which she paid $8,000 per month. How should her assessable income be computed?

If Ms H’s employer has implemented proper controlling procedures over how its employees’ housing benefits are actually utilised, the Assessor might accept that Ms H was provided with a place of residence by her employer. However, as Ms H only used $8,000 on the payment of rent, the remaining $2,000 would be regarded as a cash allowance. Her assessable income would be computed as follows.

|

|

|

$ |

|---|---|---|

|

Salary |

$(50,000 x 12) |

600,000 |

|

Cash allowance |

$(2,000 x 12) |

24,000 |

|

|

|

624,000 |

|

RV |

$(624,000 x 10%) |

62,400 |

|

Assessable Income |

|

686,400 |

Ms H's Tax Return − Individuals (BIR60)

Appendix to BIR60

Ms H's Employer's Return of Remuneration and Pensions (IR56B)

If the employer has not implemented proper controlling procedures over the housing benefits, the Assessor would treat the full amount of $10,000 as a cash allowance. Ms H’s assessable income would then be computed as follows.

|

|

|

$ |

|---|---|---|

|

Salary |

$(50,000 x 12) |

600,000 |

|

Cash allowance |

$(10,000 x 12) |

120,000 |

|

Assessable Income |

|

720,000 |

Special Cases

The Assessor will examine the following types of cases critically before accepting or rejecting that a place of residence has been provided by an employer:

- an employee lets his own property to himself or rents the property from a connected person (such as spouse) and then claims rental reimbursements from his employer; or

- an employee lets his own property or a connected person’s property to his employer and the employer provides that property to him for use as a place of residence.

In such cases, the Assessor will ask the employee and/or the employer to provide evidence showing a genuine landlord and tenant relationship exists between the contracting parties. The Assessor will take the following factors into account before making a decision:

- whether the rent is above the market rent;

- whether the normal letting formalities (such as the stamping of the tenancy agreement and periodic issuance of rental receipts) have been executed; and

- whether the ordinary rights and obligations of landlord and tenant have been observed.

Retention of Documents

When filing your tax return, you need not attach your tenancy agreement, rental receipts or other documents that provide evidence of rental payment. Such documents, however, should be retained so that they can be provided upon request to the Assessor for review.

Enquiries

If you have any enquiries you can:

- telephone the Enquiry Service Office (187 8022); or

- visit the Central Enquiry Counter at:

G/F, Inland Revenue Centre,

5 Concorde Road, Kai Tak, Kowloon, Hong Kong.