FAQs about filing of Profits Tax Return through the Internet

-

Q1.What services relating to the electronic filing of Profits Tax return are available under eTAX?Ans

eTAX provides the following four services relating to the electronic filing of Profits Tax returns:

- Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return (for attaching supplementary forms, other forms, financial statements and tax computation to the return)

- Completion of Profits Tax Return (for filling in return information)

- Submission of Profits Tax Return (for signing and submission of a return through the electronic filing mode or printing of a return for signing and submission through the semi-electronic filing mode)

- Viewing of Profits Tax Return (for viewing returns submitted through the electronic filing mode)

-

Q2.Is filing of Profits Tax Return through the Internet secure?Ans

Yes. Please refer to our eTAX Security Statement.

-

Q3.Can I file Profits Tax return for any year of assessment through the Internet?Ans

No. Only Profits Tax returns for the years of assessment 2022/23 and 2023/24 issued to a corporation/business can be filed electronically under eTAX.

-

Q4.Who can use the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service to upload required forms and Supporting Documents and the “Completion of Profits Tax Return” service to complete the return? If I do not have an eTAX Account, can I use the service?Ans

Any person appointed by the corporation/business (including tax representatives and service providers) can use the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service and the “Completion of Profits Tax Return” service, irrespective of whether he has an eTAX Account or not.

-

Q5.Where can I find the “Return Identification Number (RIN)”? If no “Return Identification Number (RIN)” is printed on the return, can I use the Internet filing service?Ans

“Return Identification Number (RIN)” is printed on the top right hand corner of the front page of the Profits Tax return. If no “Return Identification Number (RIN)” is printed on the return, both the return and the Supporting Documents cannot be filed through the Internet and have to be filed in paper form. If submission of supplementary form and other form is required, please contact us at the telephone number printed on the return during office hours.

-

Q6.Is a company allotted the same “Return Identification Number (RIN)” for its return every year?Ans

No. A company will have a different “Return Identification Number (RIN)” for the return of each year of assessment. Therefore, you must use the “Return Identification Number (RIN)” printed on the return of the relevant year of assessment when using the Internet filing service.

-

Q7.If I have to attach more than one supplementary form and/or other form to the Profits Tax return, can I upload some of the supplementary forms and other forms through the Internet while submit the others in paper form?Ans

No. Starting from 1 April 2023, ALL required supplementary forms (S1 to S18 and S20) and other forms (IR1478, IR1481 and IR1482) must be submitted electronically.

-

Q8.Can I upload supplementary forms and other forms through the Internet while submit Profits Tax return and Supporting Documents in paper form?Ans

Yes. After uploading the required supplementary forms and/or other forms via the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service, you can print and sign the Control List (with QR code) for supplementary form and other form uploaded via the same service and submit with the return and Supporting Documents in paper form together. The Control List must be signed by the same person signing the tax return.

-

Q9.If I have to attach more than one supplementary form and/or other form to the Profits Tax return, do I need to print a Control List for each form uploaded?Ans

All supplementary forms and other forms to be submitted must be zipped into one single file in advance for uploading. Only one Control List comprising of all required forms uploaded should be submitted together with the return.

-

Q10.Can I zip supplementary forms, other forms, financial statements and tax computation using my own software but not via the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service?Ans

No. Files to be uploaded must be zipped by the zip function of the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service. Besides, the default file names of the Zip files allotted by the system must not be amended.

-

Q11.If I wish to submit the Profits Tax return through the semi-electronic filing mode, should I upload the required supplementary forms, other forms, financial statements and tax computation before or after completing the return?Ans

You are advised to upload the required supplementary forms, other forms, financial statements and tax computation through the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service first.

If you upload the required supplementary forms, other forms, financial statements and tax computation after completing and saving a draft return, you have to open the draft return and refresh the “Required Forms and Supporting Documents to Profits Tax Return” screen of the “Completion of Profits Tax Return” service and save the draft return again for submission.

Uploading of supplementary forms, other forms, financial statements and tax computation would not be allowed once the Profits Tax return is submitted.

-

Q12.Can I add a new supplementary form and/or other form, replace or remove one of the supplementary forms and other forms that have already been uploaded through the Internet?Ans

You can replace or remove the supplementary forms and other forms previously uploaded or add new ones only if the Profits Tax return is yet to be submitted.

You need to zip the new or amended supplementary forms and other forms with the other valid forms, and upload this Zip file to replace the previous uploaded one. Should you need to remove a particular supplementary form or other form, you can zip the other valid forms again and upload this Zip file to replace the previous uploaded one.

For situation where the Profits Tax return has already been submitted, please refer to Q37.

-

Q13.The paper Control List for supplementary form and other form uploaded is damaged. Can I print a duplicate?Ans

You can access the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service and select “Print Control List for Supplementary Form and Other Form Uploaded” to print the Control List afresh.

-

Q14.I understand that the iXBRL financial statements and tax computation will go through the validation process before proceeding to submission of Profits Tax return. When will the result be released?Ans

The validation result, which focuses on schema and business rules, will be provided within one working day. An alert e-mail about the release of result will be sent to the e-mail address provided by the contact person on the screen that is used to upload data files. You can access the “Upload Zip File for Supporting Documents to Profits Tax Return” screen of the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service to check the validation result.

-

Q15.Can I replace the financial statements and/or tax computation that have already been uploaded and passed validation checking through the Internet?Ans

You can replace the financial statements and tax computation previously uploaded only if the Profits Tax return is yet to be submitted.

You need to zip the amended financial statements and tax computation separately and then upload these Zip files in one single transaction to replace the previous files.

For situation where the Profits Tax return has already been submitted, please refer to Q37.

-

Q16.I have uploaded Zip files for supplementary forms and other forms, financial statements and tax computation but not yet submitted the Profits Tax return. How long will the Inland Revenue Department keep these files?Ans

Uploaded Zip files not submitted with Profits Tax return would be purged by mid of the nearest March following the uploading. Data files may need to be prepared afresh for submission.

-

Q17.Can I save a partially completed Profits Tax Return for further completion and submission later?Ans

Yes. You can download and save the input data in your computer or other storage device by clicking on the [Save] button during the completion of Profits Tax Return process. To retrieve the data saved and continue to complete the return later, please return to the “Completion of Profits Tax Return” service to open the encrypted file. After you have checked that the information shown on the draft return in “Step 5 – Save Draft Return for Submission” is in order, please click on the [Save for Submission] button at the bottom to store the draft return in your computer or other storage device for submission later.

-

Q18.Can a company retain the draft return file and use it for completion of its tax return for the next year?Ans

No. A company will have a different "Return Identification Number (RIN)" for the return of each year of assessment. The system cannot open the draft return file of last year if you use it to file the return for this year for the reason of unmatched RIN.

-

Q19.Is it secure to save the draft return in my computer or other storage device?Ans

Yes. The draft return file is encrypted and can only be opened through the “Completion of Profits Tax Return” service or “Submission of Profits Tax Return” service.

-

Q20.I have used the “Completion of Profits Tax Return” service to prepare a draft return. Does the Inland Revenue Department know or retain the content of the draft return?Ans

No.

-

Q21.Can I print the simplified Profits Tax Return and sign on its declaration part, and then submit the printed copy?Ans

Yes. You can select semi-electronic filing mode under “Submission of Profits Tax Return” service and print the return with QR code and Transaction Reference Number (TRN). The system will give a unique TRN to each printed Profits Tax return. Only the latest printed return will be accepted.

-

Q22.It was unsuccessful in my attempt to print the simplified Profits Tax return through the semi-electronic filing mode under the “Submission of Profits Tax Return” service. How should I deal with the situation?Ans

The simplified return will be displayed in a pop-up window for you to preview before printing by clicking the “Print Return for Signing” button either in “Step 5 – Print Return for Signing” (if filed in the capacity of taxpayer) or “Step 6 – Print Return for Signing” (if filed in the capacity of service provider) of the “Submission of Profits Tax Return” service. If you cannot see the pop-up window by clicking the “Print Return for Signing” button, please check if your browser setting has blocked pop-up windows; and if so, change the setting before the next attempt to enter the service and print the simplified return.

-

Q23.I am the director of a corporation and have used the “Completion of Profits Tax Return” service to prepare the draft return. How should I submit the Profits Tax return?Ans

If you wish to submit the return through the electronic filing mode, you are required to log onto your personal eTAX Account and use the “Submission of Profits Tax Return” service to retrieve the draft return file. You will be required to input your designation as Director before you can sign and submit the Profits Tax return electronically.

If you wish to submit the simplified return in paper form, you need not log onto your eTAX Account. You can select semi-electronic filing mode via the “Submission of Profits Tax Return” service to print the simplified return for signing and submission. You can retrieve the draft return file by inputting the Profits Tax File Number and RIN, which are printed on the paper Profits Tax return for identification. You will be required to provide your name and designation before you can print the return for signature and submission in paper form. The printed return must be signed by an authorized signer specified in Q25.

-

Q24.I am engaged by my client to act as the service provider for furnishing the Profits Tax return for or on his behalf. Is there any difference in online submission of Profits Tax return?Ans

You are required to upload a scanned copy of the duly signed “Confirmation for Engagement of Service Provider to Furnish Return” (IR1476) in PDF format via the “Submission of Profits Tax Return” service before you can sign and submit the return.

Besides, you can choose to sign the return online by your recognized organizational digital certificate.

-

Q25.Who can use the “Submission of Profits Tax Return” service to sign and submit Profits Tax return electronically?Ans

To file the Profits Tax return electronically, the return filer must be a personal eTAX Account holder in one of the following capacities:

For Profits Tax Return – Corporations (BIR51)

- Director

- Secretary

- Manager

- Investment Manager (only applicable to a corporation that is an open-ended fund company)

For Profits Tax Return – Persons Other Than Corporations (BIR52)

- Precedent partner

- Proprietor (only if the business was changed from a partnership to a sole proprietorship during the basis period for the year of assessment)

- Executor of the deceased person

- Agent / Manager (only if there is no resident proprietor or partner in Hong Kong)

- General partner in the limited partnership fund (LPF)

- Authorized representative as defined in section 2 of the Limited Partnership Fund Ordinance (Cap. 637)

- Investment manager of the LPF

- Principal officer of the body of persons

Profits Tax return may also be signed and submitted by a service provider for or on behalf of the taxpayer. The service provider must have obtained "Confirmation for Engagement of Service Provider to Furnish Return" (IR1476) from the taxpayer stating that all information contained in the return, any required supplementary forms and other forms and the Supporting Documents is correct and complete to the best of the taxpayer’s knowledge and belief. Other than the signing methods applicable to an eTAX Account holder, the service provider may use an organizational certificate issued by a recognized certification authority.

At present, only individuals can open eTAX Accounts. If you wish to sign the Profits Tax return electronically by personal eTAX Account but do not have one, please go to www.gov.hk/etax and complete a simple registration process to open one.

-

Q26.How can I sign the Profits Tax return electronically?Ans

The return filer who is in one of the capacities specified in Q25 will need to use his eTAX Password, MyGovHK Password, recognized personal digital certificate or “iAM Smart” account with digital signing function to sign the return. If the return filer is a service provider engaged by the taxpayer to furnish the Profits Tax return, he can use a recognized organizational digital certificate to sign the return for or on behalf of the taxpayer as an alternative to the above-mentioned personal authentication means.

-

Q27.Can the tax representative or the service provider use my Taxpayer Identification Number and Password to submit the Profits Tax return for me through the Internet?Ans

All tax returns submitted through your eTAX Account will be treated in the same way as tax returns in paper form that have been signed by you. You are personally accountable for the accuracy of the information furnished. Hence, to protect your interest, at no time and under no circumstances should you allow other persons to use your Taxpayer Identification Number (TIN) and Password.

-

Q28.The draft return is prepared using the English return form of the “Completion of Profits Tax Return” service. Can I change the return form language to Chinese when submitting the return?Ans

You can use the Chinese version of the “Submission of Profits Tax Return” service to open the draft return. The simulated return form will be displayed in Chinese for your verification.

-

Q29.What should I do if I need to correct the information in the draft return before submission of the Profits Tax return?Ans

For return information other than supplementary forms, other forms, financial statements and tax computation, you can use the “Completion of Profits Tax Return” service to retrieve the draft return saved and go to the relevant parts to make amendments. After amendment, please proceed to “Step 5 – Save Draft Return for Submission” to verify the information on the draft return. If all the information is in order, please click on the [Save for Submission] button to download and save the draft return in your computer or other storage device for submission later.

If you find an error when you are using the “Submission of Profits Tax Return” service, please click on the [Amend] button at the bottom of the simulated return to go to the “Completion of Profits Tax Return” service to correct the return information.

For amendment of information in supplementary forms, other forms, financial statements and tax computation, please refer to Q12 and Q15.

-

Q30.How do I know that I have successfully filed the Profits Tax return through the Internet?Ans

An acknowledgement bearing a Transaction Reference Number will be shown on your computer screen immediately after you have successfully filed the Profits Tax return through the Internet.

If you require the Inland Revenue Department to inform any other person about the acknowledgement of your submission of the Profits Tax return, please provide his email address in the step of “Sign and Submit” of the “Submission of Profits Tax Return” service. Being authorized by you, the Department will send an acknowledgement email to the designated e-mail address under e_alert@ird.gov.hk simultaneously with the acknowledgement given to you. If you are engaged by your client to be a service provider to furnish the Profits Tax return for or on his behalf, you are recommended to notify your client about the electronic submission of return through this channel.

-

Q31.I have filed the Profits Tax return through the Internet. Can I view, save and print the return?Ans

Yes. You can use the “Viewing of Profits Tax Return” service to view, save and print the Profits Tax return as soon as you have submitted it through the Internet within 1 month from the date of submission. You are recommended to print a copy or save it for record purposes. A return that is saved in computer or other storage device can be viewed after connecting the computer to the Internet. If you are engaged by your client to be a service provider to furnish the Profits Tax return for or on his behalf, you are recommended to print a copy and provide it to your client for record purposes.

-

Q32.Is there any time limit for using the “Completion of Profits Tax Return” service or “Submission of Profits Tax Return” service to open a draft return file?Ans

You cannot open a draft return file again in the following circumstances:

- the Profits Tax Return has already been submitted

- the return template in the "Completion of Profits Tax Return" service has been updated after the draft return file was prepared

If you wish to keep the draft return for record purposes, please print the page immediately after you have completed "Step 5 - Save Draft Return for Submission".

-

Q33.In what circumstances the return template of the “Completion of Profits Tax Return” service would be updated?Ans

The return template of the "Completion of Profits Tax Return" service will be updated if the return information required is changed. Normally, the update will take place on April 1st of each year. Return drafts prepared prior to the annual update can no longer be used.

-

Q34.What are “Check Sums”? Where can I find them when using the Internet filing service?Ans

“Check Sums” are derived from the data files.

Check Sums of supplementary forms, other forms and respective Zip files containing supplementary forms and/or other forms, financial statements and tax computation are shown:

- on the acknowledgment displayed in the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service after successful uploading of the Zip file(s)

- on the “Required Forms and Supporting Documents to Profits Tax Return” screen of the “Completion of Profits Tax Return” service

- within the part of “Details of the Electronic File(s) Uploaded” on the draft return in the “Completion of Profits Tax Return” service

- within the part of “Details of the Electronic File(s) Uploaded” on the simulated return in the “Submission of Profits Tax Return” service

- within the part of “Details of the Electronic File(s) Uploaded” on the return shown in the “Viewing of Profits Tax Return” service

Check Sums of the return are shown:

- on the draft return in the “Completion of Profits Tax Return” service

- on the simulated return in the “Submission of Profits Tax Return” service

- on the acknowledgement displayed in the “Submission of Profits Tax Return” service immediately after submission of the return

- on the return shown in the “Viewing of Profits Tax Return” service

-

Q35.How can I ensure that the details of supplementary forms and other forms printed on the Control List are the same as those uploaded via the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service?Ans

The details of supplementary forms and other forms, including

- file name and Check Sum of the Zip file;

- Check Sum of each embedded supplementary form and other form; and

- the transaction reference number shown on the acknowledgement displayed in the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service after successful uploading of the Zip file

are listed in the Control List. You can compare these values to ascertain the accuracy. If any discrepancy is spotted, you have to check if new Zip file has been uploaded and print a new Control List through the “Uploading of Data Files for Required Forms and Supporting Documents to Profits Tax Return” service accordingly.

-

Q36.How can the return preparer and I ensure that the return data, including the details of supplementary forms, other forms, financial statements and tax computation submitted electronically are the same as those in the draft return prepared in the “Completion of Profits Tax Return” service?Ans

The details of supplementary forms, other forms, financial statements and tax computation, including

- file names and Check Sums of the Zip files; and

- Check Sum of each embedded supplementary form and other form

are listed in the draft return. You and the return preparer can compare these values to ascertain the accuracy. If any discrepancy is spotted, you have to check if new Zip files have been uploaded and refresh the “Required Forms and Supporting Documents to Profits Tax Return” screen through the “Completion of Profits Tax Return” service accordingly.

For return data other than supplementary forms, other forms, financial statements and tax computation, a Check Sum is shown on the draft return in the “Completion of Profits Tax Return” service, the simulated return in the “Submission of Profits Tax Return” service, the acknowledgement of submission of the return and the return shown in the “Viewing of Profits Tax Return” service. It is derived from the information entered in the return. If the content of the draft return is the same as the return submitted, the Check Sums shown on the aforesaid screens should be the same. Therefore, you and the return preparer can compare the values of the Check Sums to ascertain whether the same return data were submitted.

-

Q37.I have filed the Profits Tax return through the electronic filing mode or semi-electronic filing mode but there are some errors in the return. How can I rectify the errors or add supplements to the return?Ans

Please give a duly signed written notice to the Commissioner of Inland Revenue with particulars including your name, capacity, name of the corporation/business, file number, the relevant year of assessment and details of the amendment or supplement. You should not use the 4-page paper Profits Tax return for this purpose. In case you are a service provider engaged by your client to furnish the Profits Tax return for or on his behalf, please notify your client to submit the aforesaid written notice.

-

Q38.Can I obtain an additional extension of time to submit the Profits Tax Return if I choose to file the return through the Internet?Ans

If you choose to file the Profits Tax Return through the Internet, you can apply for an additional extension of 1 month for submission of the return. For example, the Profits Tax Returns for the year of assessment 2023/24 to be issued on 2 April 2024 would have the Internet filing extended due date upon application as follows:

Not under the Block Extension Scheme (cases without tax representatives)

Filing due date

Internet filing extended due date upon application

2 May 2024

2 Jun 2024*

Under the Block Extension Scheme (cases with tax representatives)

Accounting

dateExtended

due dateInternet filing extended

due date upon application1 Apr 2023 – 30 Nov 2023 (Accounting Date Code “N”)

2 May 2024 2 Jun 2024* 1 Dec 2023 – 31 Dec 2023 (Accounting Date Code “D”) 15 Aug 2024 15 Sep 2024* 1 Jan 2024 – 31 Mar 2024(Accounting Date Code “M”)

15 Nov 2024

(not a loss case)15 Dec 2024* 31 Jan 2025*

(loss case)31 Jan 2025* * If the extended due date falls on a Sunday or public holiday, it will be extended to the following day which is neither a Sunday nor a public holiday.

-

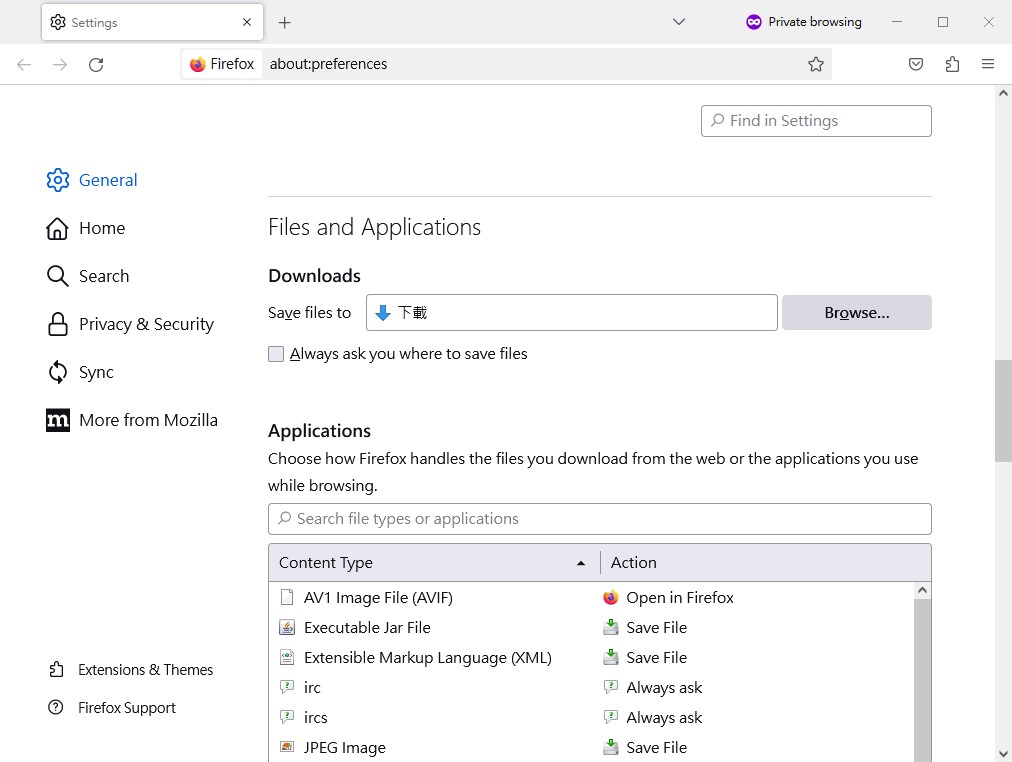

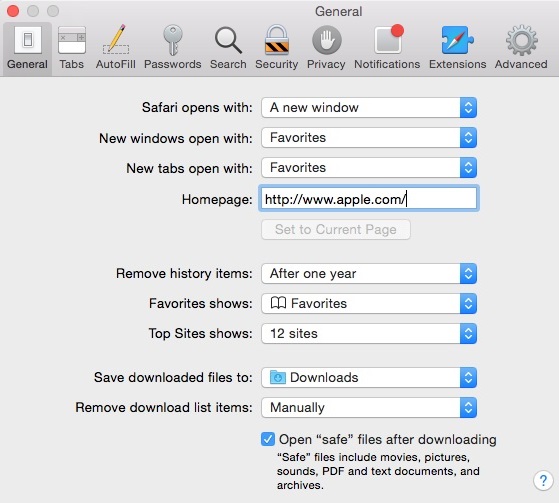

Q39.How can I specify the destination folder/directory name when I save the Draft Return using FireFox and Safari?Ans

The Draft Return is downloaded to the default saving directory of your FireFox and Safari. You could change the default saving directory by taking the following steps:

- If you are using Firefox, the default saving directory can be set by:

- From the menu bar, selecting “Settings”;

- Selecting “General” > “Downloads”;

- Turning on the “Save files to” option and clicking on the “Browse” button to select your preferred destination folder or turning on the “Always ask me where to save files” option.

- If you are using Safari, the default saving directory can be set by:

- From the menu bar, selecting “Preference” > “General”;

- Selecting your preferred destination folder for “Save downloaded files to:” option.

- If you are using Firefox, the default saving directory can be set by: